The exciting journey to an initial public offering (“IPO”) requires careful planning regarding your company’s 409A valuations. You must ensure compliance with regulations to avoid disruptions during your big launch into the public markets. If your company is contemplating an IPO in the next 18 months, your 409A valuations should include thoughtful IPO assumptions that can withstand review by the Securities and Exchange Commission (“SEC”). Updating your 409A frequently is also necessary to remain current with the rapidly changing dynamics of your company’s listing plans and market pricing. This article delves into the 409A refresh cycle, typical IPO timeline, SEC review process, and the key IPO assumptions to be incorporated in your company’s 409A valuations.

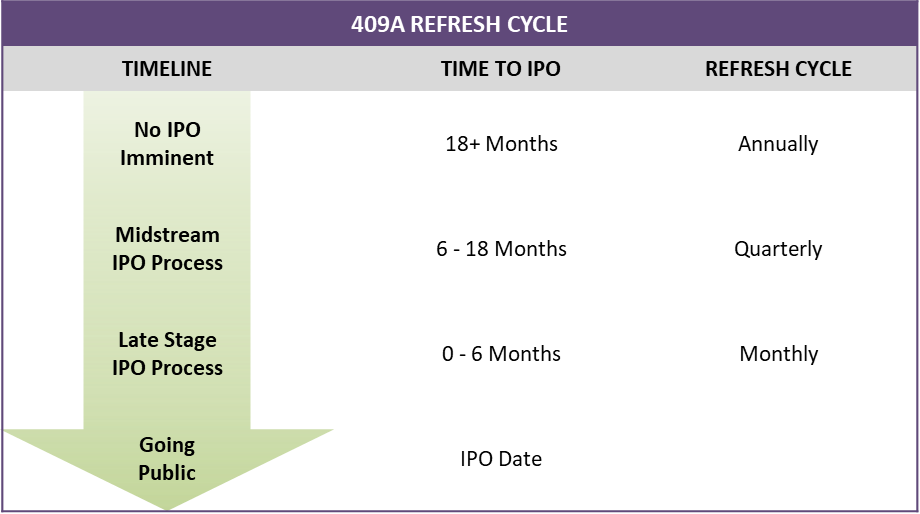

409A Refresh Cycle

The IRS’ Safe Harbor Rules provide private companies with a one-year period in which they can rely on the common stock fair value estimate, unless certain triggering events have occurred since the prior 409A valuation. Examples of common triggering events facing IPO track companies include:

- Equity Financing Rounds: New funding rounds or the closing of second tranches can significantly change a company’s valuation.

- Secondary Market Transactions: Sales of stock by existing shareholders provide observable indications of the value of a company’s outstanding shares. The significance of any secondary market transactions must be assessed given their size, recency, frequency, and the nature of the counterparties and price-setting negotiations.

- Significant Events: Events can include new product launches, positive data in clinical studies, entrance into material partnerships, and hiring of critical personnel, among others.

- IPO Progression: Advancing through the IPO timeline events discussed later in this article can signal that key assumptions have changed, such as the probability, timing, and pricing of an IPO.

For many IPO track companies, the 6 – 9 months preceding their expected IPO date bring numerous corporate developments that necessitate more frequent 409A valuation updates. At this point, the 409A refresh cycle becomes as frequent as quarterly or even monthly. The timing of material new option grants can also drive the need for a fresh 409A valuation. A company should therefore maintain open communication with its third-party valuation firm to ensure timely 409A valuations that adequately reflect its progression through the IPO timeline. A typical 409A refresh cycle by a company’s timeline in the IPO process is presented below.

IPO Timeline

Early Planning

At the beginning of its IPO journey, a company holds high-level discussions with its board of directors and key stakeholders to socialize the prospect of an IPO. If the board and key stakeholders favor exploring an IPO, the company performs an internal assessment to assess its IPO viability and readiness. The company then begins drafting its IPO strategy and determining key milestones, such as gaining investor support, reaching certain revenue and profitability targets, or advancing its clinical pipeline. Concurrently, the company undertakes external audits to ensure its financial statements meet rigorous public market standards. During their review, auditors also examine current and past 409A valuations to ensure they can withstand SEC inspection and avoid “cheap stock” issues.

Org Meeting

Following the internal assessment discussed above, the company typically holds an “org up” meeting to align around the proposed IPO strategy. This includes communicating the reasons for going public, a proposed timeline, and roles and responsibilities. The company also educates employees on what the IPO means for the company, applicable regulatory requirements, and the impact on their roles. Regular meetings throughout the IPO process provide updates on key milestones, such as selecting underwriters, filing the S-1 registration statement, and receiving regulatory feedback.

Selecting Underwriters

In what is known as a “bake off,” the company meets with investment banks to determine the best fit for underwriting its IPO. This competitive process allows the company to select lead underwriters, who will guide the IPO process and help price the offering.

Drafting the Confidential S-1 Registration Statement

With its legal and financial advisors, the company drafts its S-1 registrational statement, detailing its business operations, financial condition, and capital structure. Under the Jumpstart Our Business Startup Act (“JOBS Act”), an emerging growth company (less than $1 billion in revenue) may submit its draft S-1 confidentially to the SEC, allowing it to address comments and make revisions without public scrutiny. This process provides flexibility and reduces market pressure during the early stages. Following receipt of the draft S-1, the SEC performs an initial review and provides comments and questions, which the company addresses through subsequent revisions.

Testing the Waters

Before publicly filing its S-1, a company may hold discussions with potential investors to gauge interest in an IPO. This phase, known as “testing the waters,” helps the company better understand market reception and refine its IPO strategy. If investor feedback is negative, the company can abandon the offering before its S-1 becomes effective, keeping the submission confidential. The company must adhere to SEC guidelines to ensure compliant and non-misleading communications.

Publicly Filing the S-1 Registration Statement

After addressing all SEC comments on the draft S-1, the company publicly files the S-1, making it available for investors and the public. The IPO can proceed once the SEC declares the S-1 effective. Publicly filing the S-1 typically attracts significant investor and media interest. Juxtaposed with this sudden increase in attention, the company must diligently avoid communication restriction violations (also known as “gun jumping”) by following “quiet period” rules. For this reason, designating spokespersons and crafting a communication plan are essential to avoid the appearance of promoting the offering, which could delay or derail the IPO.

Roadshow and Pricing

With the S-1 publicly filed, the company’s management team presents to potential investors to generate interest in the public offering. The final offer price is set based on investor feedback. SEC rules require companies to unveil financials at least 15 days before the investor roadshow, giving investors time to review materials before discussions.

Going Public

The company’s stock begins trading on the chosen exchange. The company must now adhere to public company reporting and compliance standards.

SEC Review Process

The SEC’s review process is crucial in the IPO timeline. The SEC scrutinizes all financial disclosures, including 409A valuations, over a “look-back period” of two years or more. The goal is to ensure the company’s financial statements are accurate and transparent for potential investors.

Common SEC Concerns

The SEC examines whether stock options were issued at a significant discount to the fair value of the underlying common stock as this could raise a red flag and may lead to a “cheap stock” charge. The SEC also evaluates the frequency of 409A valuations and the methods used to determine fair value. Consistency and reliability of the valuation methods selected are critical. Furthermore, any significant changes in valuation assumptions and methodologies close to the IPO date are scrutinized to ensure they reflect genuine changes in market conditions or company performance rather than attempts to manipulate the fair value of the common stock.

Best Practices for SEC Compliance

The company should engage a reputable third-party valuation firm to provide regular 409A valuations. This ensures adherence to industry best practices regarding the valuation process, methodologies, assumptions, and documentation. Simultaneously, company management should review the 409A valuations to assess the reasonableness of selected methods and outcomes. The company must be prepared to explain and justify the valuation methods and outcomes to the SEC.

Benefits of Early Compliance

Accurate and transparent financial disclosures build investor confidence in company management and its financial statements. Engaging a reputable valuation team early in the 409A valuation cycle can help avoid significant SEC commentary and questions, reducing the time and resources spent on SEC inquiries and S-1 revisions. This leads to a smoother IPO process for all parties involved.

For more information from the SEC on going public, click here. Certain compliance and disclosure interpretations are also provided here.

IPO Assumptions in 409A Valuations

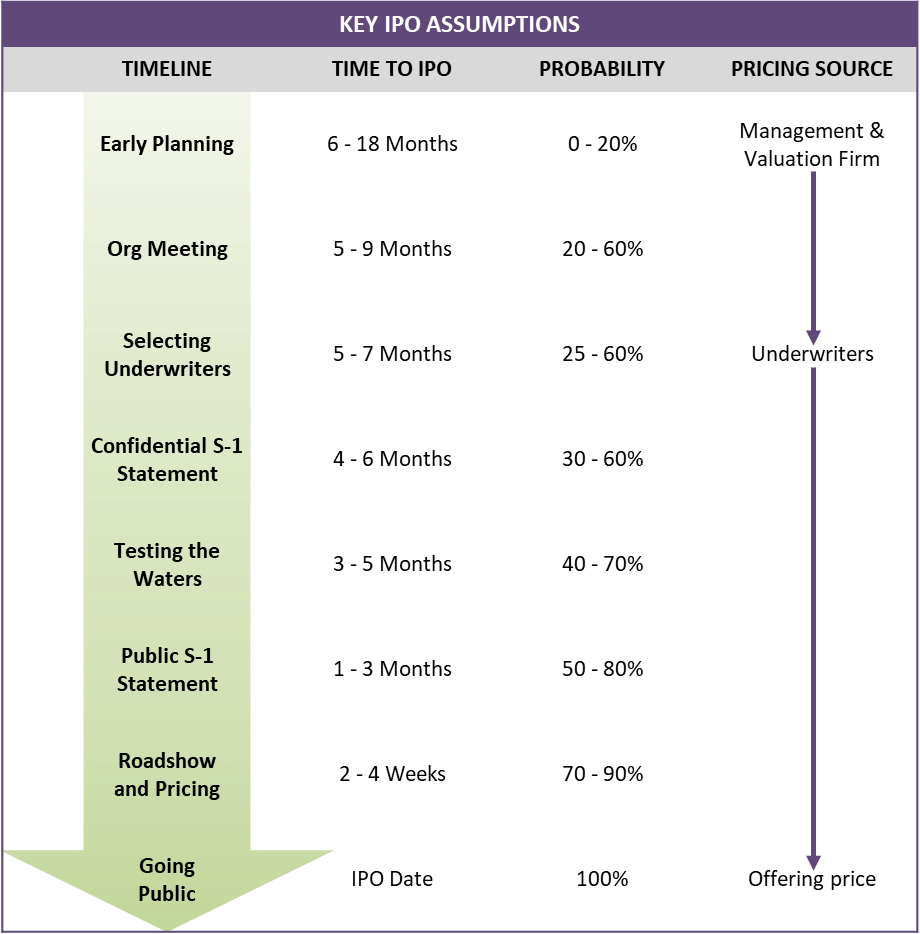

409A valuations rely heavily on assumptions provided by a company’s management team. Management must therefore provide reliable assumptions regarding the probability, timing, and pricing of a contemplated IPO. These assumptions should reconcile with the company’s current stage in the IPO timeline and the best information available at each valuation update. While every company’s journey to IPO is unique, the chart below provides ranges for these key assumptions by each IPO timeline stage.

Probability of an IPO

The probability of an IPO is a critical assumption and requires considerable attention in a 409A valuation. The probability ranges provided above are intentionally wide due to the multitude of factors affecting each company’s IPO potential. The estimate should consider the company’s current IPO timeline stage, key events such as securing bridge financing or advancing its clinical pipeline, the board’s viewpoint, current and projected market conditions, and investor receptiveness towards an IPO.

Timing of an IPO

The timing of an IPO affects the discounting of a future value and the determination of a reasonable discount for lack of marketability. This assumption should consider the company’s financial audit calendar, significant business developments, indications from the board and underwriters, current and projected market conditions, and possibly the political election cycle. Additionally, companies often pursue multiple IPO timelines, such as an “early IPO” and a “late IPO,” requiring the 409A valuation to model multiple scenarios. Further, some companies may progress rapidly through the IPO timeline stages and sometimes out of order, like seeking underwriters before the org up meeting.

Source of IPO Pricing

In the early IPO timeline stages, it is unlikely that pricing indications from underwriters or investments banks will be available. The company may have to rely on its management’s best estimates or benchmarking analyses performed by its valuation firm. As the company progresses, pricing indications from its underwriters or prospective investors becomes more likely. The 409A valuation should reflect the best information available at each analysis, prioritizing underwriters’ and investors’ pricing indications when available.

Conclusion

Preparing for an IPO involves meticulous planning and adherence to regulatory requirements, with 409A valuations playing a pivotal role. You can navigate the IPO path with greater confidence and speed by understanding the 409A refresh cycle, typical timelines, SEC review process, and key IPO valuation assumptions. For additional information, the Big 4 have published these excellent IPO guides:

Deloitte: A Roadmap to the IPO Process

PwC: Roadmap for an IPO